Recap VNG Connect No.3/2022

Besides staying updated with our company’s latest achievements in Quarter 3 2022, we will welcome Dinh Kim Nhung – the new SMT member who will take on the role of Human Resources Director at VNG.

I. BUSINESS ACTIVITY REVIEWS IN Q3 2022 & OVERALL STRATEGY FOR Q4

1/ GENERAL UPDATES

Dinh Kim Nhung will take on the role of Director of Human Resources. She is trusted to contribute more value to employee development and the company.

a. Economic background

– Global economy is entering a period of a dramatic downtrend. Vietnam is expected to be significantly affected, especially in the banking and real estate sectors.

– VNG business segments remain stable in operation. However, the gaming segment in 2022 is facing more challenges, compared to last year’s robust growth due to COVID-19.

b. Business updates

– The Chinese game market has been affected for three years due to government policies in the gaming industry. However, this effect is predicted to be short-termed. GE teams are fully capable to grow the business, especially growing the business internationally.

+ In 2022, the proportion of revenue coming from foreign markets may reach up to 25% and will be expected to reach 50% in the next 3 years. As we follow our value of “Embracing Challenges”, GE can completely conquer the Games segment in Vietnam.

+ In 2021, ZA faced several difficulties but in 2022 observes a strong development.

+ In Quarter 3, ZaloPay met the overall KPI and other growth factors appeared to be positive.

+ Other long-term investments in VNG such as Cloud, AI, and IoT show positive signs.

– VNG is confident in our business unit strategies. However, we will have to be careful and be well-prepared for any possible backwinds in 2023.

– Dinh Kim Nhung was first introduced to all of the Starters as the new Director of Human Resources. Nhung is a seasoned professional in HR with experience in many different industries. With the spirit of being willing to learn and non-stop contribution, Nhung is ready for long-term development with VNG.

2/ BUSINESS SITUATION OF GAME ENTERTAINMENT

a. Quarter 3’s recap

– Overall, the third quarter in GE was much better than quarter 2. Some of the key highlights include:

+ Play Together: Launched at the end of June, the GS9 team has had a great start reaching an NRU of 8.3 million users and a DAU of over 471,000.

+ Gunny: After the successful launch in Vietnam, we continue to launch the game in Taiwan, Hong Kong, Singapore and Malaysia.

+ JXMax was launched in Vietnam in late September. They did an amazing job in getting the game off the ground and continuing our strong partnership with Kingsoft and the JX series.

b. Game Management Team’s sharing and Quarter 4’s plan

None of us knows what the future holds. The best we can do is prepare. As we observe the situation in Vietnam and globally, we will face many challenges. As a business, the more global we become, the more issues we face.

Global political and economic prospects start affecting our business as we grow and expand. It has been a growing issue with GE as we expand to different countries and cooperate with various partners. As part of our value, we embrace these challenges. At the same time, we have to be much more cautious, particularly with the capital we are looking to deploy and where we are deploying it.

As we enter the planning phase of the year, everyone needs to:

– Be mindful of these challenges that we are facing in our business.

– Be opportunistic because as these challenges rise, also comes the opportunities

– Be aggressive on the opportunities, at the same time be careful.

– Continue to look for growth opportunities during this time and optimize how we do things. Look for better and more optimal ways in which we approach our data.

– We are going to have to make difficult choices and be much more focused than before.

3/ BUSINESS SITUATION OF ZALO

– The struggles of the Vietnamese market are considered to be less averse than those of the international market.– In the last quarter, ZA continued to maintain steady growth. The product still closely followed its core value of user protection.

– Media products all see growth in traffic again after the cooling down post-pandemic. Until the 3rd quarter, ZA has achieved the most brilliant revenue, growing by 30%, reaching 1430 billion.

– ZA is proud of the core value of technology: AI products such as Kiki, accounting for 90% in Android DVD market share– Another outstanding product is Fiza which exceeds the set KPI.

4/ BUSINESS SITUATION OF ZALOPAY

a. Quarter 3’s recap

– KPIs for users & merchants are very positive. Merchant Team is the first one to reach the annual KPI.

– KPIs for a number of active users and payments reached 78% and 82% annual targets, respectively. ZaloPay met KPIs in August, September, and October, which shows very positive growth to reach the 2022 target.

– Financial services products

+ “Cumulative Account” reaches 70% of the annual target.

+ “Credit Account” is planned to launch in Q4.

– Tech indicators

+ Agile delivery: the number of committed items per sprint is increasing.

+ Automated Test Coverage: very high, up to 74%.

– Initiative activities in Q.3

+ User growth: Software Customer Relationship Management is growing very well in terms of the number of users. ZaloPay has launched more different contexts for users to see more messages and gradually replaced the set-up rules with a data science model => the ability to suggest the right next actions or remind them to use the voucher at the right time. It is the priority to cut monthly programs of the following year, such as monthly games to save costs and develop more sustainably.

+ Making products to be offered to the community like universities and acquire users. In October, ZaloPay implemented the “cashless canteen” model at the International University (IU) and got a positive reception. In the first month of launching, 50% of students used ZaloPay for payment. We are also in the process of signing contracts with two other universities this year. Next year’s goal is to add ten more.

b.Quarter 4’s plan

– Merchants:

+ Exceeded annual KPI and signed contracts with many big accounts such as Starbucks, Dien May Xanh, Mobile World, and An Khang pharmacy and have very aggressive plans in the fourth quarter.

+ Continue to develop a Sales team to acquire small merchants to increase the number of points to receive ZaloPay from 4-5 times in the next year.

+ Next year, ZaloPay will develop more Merchant solutions. Currently, the team has one pilot, OA – Tap Hoa Vo No Go. This solution will help online merchants who are selling manually on Facebook to list items on Zalo and improve conversion rates. In the future, there will be a shipping solution, like combining with Ahamove delivery for users. ZaloPay has just tested Tap Hoa Vo No Go and had 23 participating shops in just the first week of its launch. Starters can contact NgocVB for feedback or sales support.

– Financial Services

+ “Cumulative Account”: Good growth in the number of users and deposits after changing the interest rate from 5% to 6%.

+ “Credit Account”: Pilot testing at VNG this Nov with more advantages in terms of interest and fees than similar products of MOMO.

5/ BUSINESS SITUATION OF VNG CLOUD

– From April 3, 2022, until now, the restructuring has been about 40%. There are promising results after this phase.

– The Cloud team focuses on foundational products such as Vserve, Vstorge, etc., and will work with the IoT team (mainly responsible from August 2022) to bring VCloud Cam to businesses.

– Compared to December 2021, all Cloud products are growing very strongly in terms of customers and revenue.

– The challenge for the Cloud team is that by the end of the fourth quarter of 2022, it will grow 100% compared to December 2021, with strong growth in core products.

– Minh shared: “Actually, Cloud is quite a challenging business because it’s new to VNG. Up to now, I haven’t been very clear about Cloud Business. But after a while of working with everyone. For others, I think this is a potential segment not only for Cloud but also for VNG. In the Vietnamese market, the growth potential for VNG in the next decades will be great for the enterprise & merchant segments. In the customer segment, we have almost reached the peak of growth (for example, in the Games segment, VNG has nearly dominated the market since its establishment, except for a few segments.

– Zalo will still be doing very well in the next 15 years, but there won’t be much room left in terms of customers. Of course, in terms of growth, it will be very good but it will come a lot from enterprises & merchants.

– Cloud is currently growing stable in product development, revenue, and customers. We won the bid for several accounts and customers from big companies like FPT, and Viettel all rate VNG Cloud’s products as the best in the Vietnam market. However, VNG’s competitors in the coming time must be foreign companies, need to find differences and competitive advantages to be able to serve customers the best.

– VNG is also preparing to open Data Center 2 in December to welcome other BUs moving from Data Center 1 as well as external partners. He hopes it will become one of the best Data Centers in Vietnam.

6/ BUSINESS SITUATION OF TSE

a. Quarter 3’s recap

– Achieved 2 ISO27001 certificates

– Regarding security awareness, in the third quarter, Uber was hacked into the system by hackers to get information. The cause was Uber employees who were scammed by hackers to get accounts to infiltrate the VPN system, taking over the entire infrastructure to affect small businesses. Therefore, the ISO team recommends that everyone use the Mobile app instead of SMS, Hardware Token, or Chrome browser to save passwords instead of saving in Word or Excel file formats.

b. Business support

– IT, TOP, and IOT teams have coordinated with AF teams to set up IT infrastructure for the office block in New DC to put into operation in August.

– Support other BUs: The team still ensures the quality of service as well as the internal customer part.

c. About myVNG: Add new features and improve Starter’s experience during working at VNG.

d. About Incubators products

– Bshield reaches 17M MAD

– Blockchain: launching YoVerse platform for VNG18, coordinating with GE to release the NFT platform

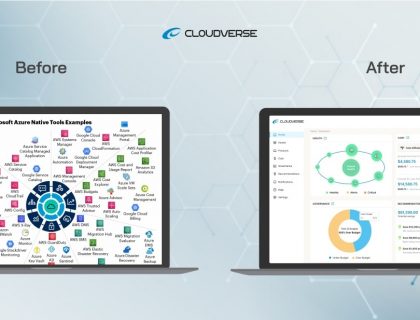

– In Q3, CloudVerse completed version 4.0 to support 4 popular Cloud platforms and allow customers to try the beta version for VNG Games and is expected to release the official version for customers in December.

7/ BUSINESS SITUATION OF FINANCE

– 2022 is an investment year, plus the business is suffering the post-COVID hangover period, so the financial performance is not as good as last year. The YTD revenue is 6.08 trillion (+4% YoY), and the net profit is 894 billion (+176% YoY).

– For the rest of 2022 to 2023, there would be lots of economic volatility worldwide, and VNG is not immune from this. However, we are surely in a good position where we have a great team and strong direction, we are clear to take action. We are focusing very much on being lean and efficient. We will emerge stronger.

8/ BUSINESS SITUATION OF HUMAN RESOURCES

a. Talent Acquisition

In the last quarter and upcoming time, HR Department advocated focusing on the quality of each candidate, especially the skills and knowledge related to Technology & Products. Thereby, the human resources department wishes support from all Starters participating in the ERP program to help ensure the quality of candidates, while ensuring the saving of recruitment costs.

b. People Development

– Learning Box: The number of starters registering to join the learning box increased dramatically. Especially with the industry’s participation and sharing from family members and veterans. In the next quarter, the learning box will focus on the Tech Talk Series, with the first topic being “InnerSource” which took place on October 27, shared by ZaloPay.

– Reading corner at VNG Campus has officially opened. 260 starters joined to borrow books on opening week.

– Preparing for Vietnam Teachers’ Day 2022 activities, specific information will be sent to Starter as soon as possible.

c. Performance Management

Officially start the year-end capacity assessment on November 1, 2022. -> Receive bonus and 13th-month salary on January 12, 2023

9/ BUSINESS SITUATION OF ADMINISTRATION AND FACILITIES

– Over the last quarter, the number of overall staff worldwide increased by 13% with 12 offices regionally. This number will increase when the economic outlook gets better.

– We have finished restructuring the library and increased four new meeting rooms where the library used to be. Understanding that the lack of meeting rooms is a nuisance, we will continue working on this issue and more technologies will be added by the end of next month.

– VNG Data Center is now open within a nice distance of VNG Campus, we can all use the bus to travel to DC and enjoy the nice canteen there.

– PRISM: We are looking to digitalize enterprises in Vietnam and the region. Some community-based activities – everything from apartment buildings to precincts to new cities: we want to incorporate this IoT Platform and provide efficiency both in utility, labor, and other activities for the enterprises. Currently working with a number of businesses on this – we will be rolling out with the Masan office over the next 4 months and it is expected that Masan will take that across the entire business when the rollout is done. We are also now heavily involved with different aspects so Phu My Hung and other businesses around Tan Thuan are the next to roll this platform out. Over the next year, I anticipate that there will be a lot more news regarding this as a new business for VNG.

START

Comments